Dubai Real Estate 2025: Quick Investor Update

Dubai’s property market continues to shine in 2025. Prices, rental yields, and transaction volumes remain strong, but a wave of new supply could test the market in late-2025 and 2026.

Key Highlights

-

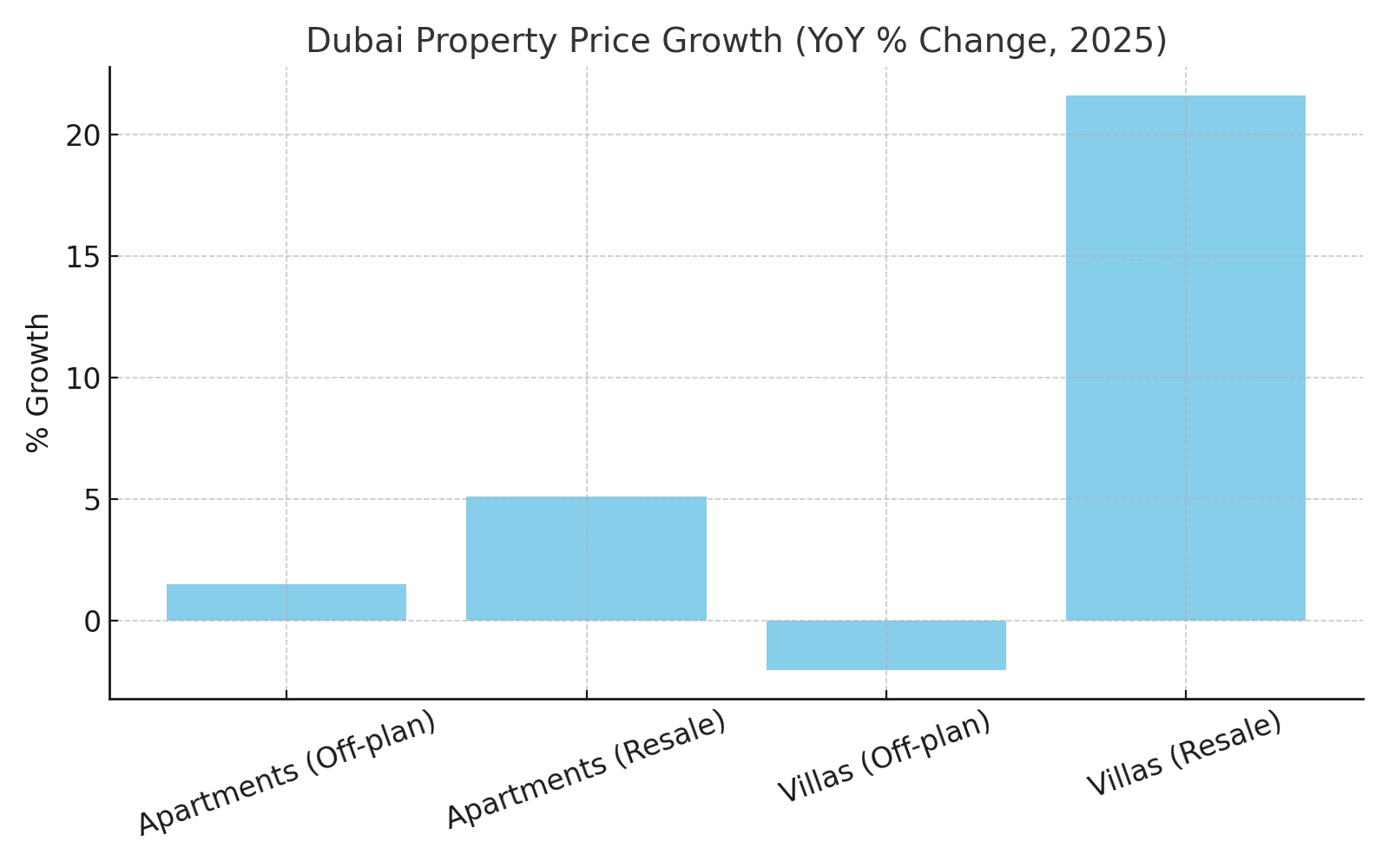

Prices: Apartments up ~5% YoY, resale villas up 20%+.

-

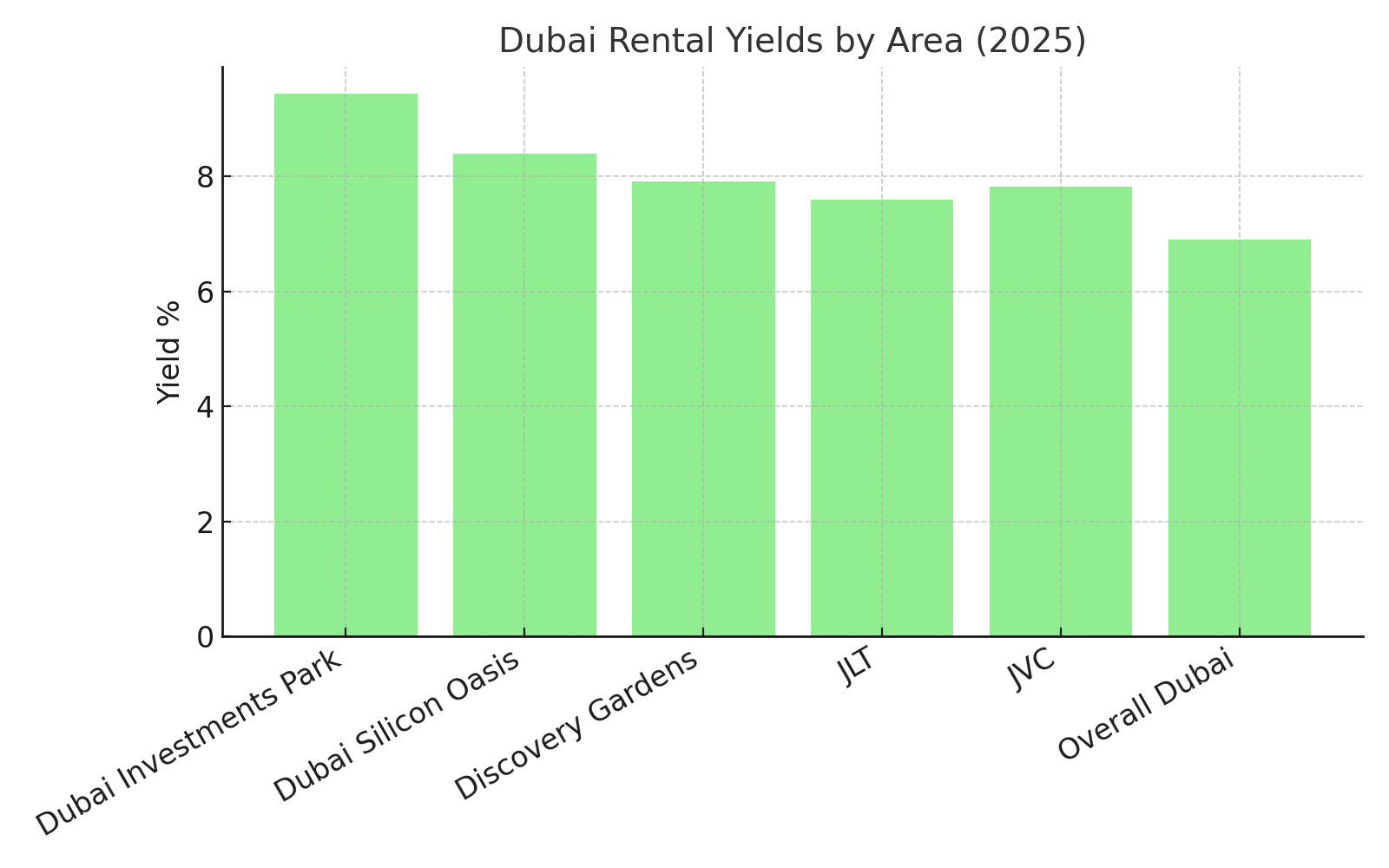

Yields: Apartments average 7%+ in JVC, JLT, Silicon Oasis; villas closer to 5%.

-

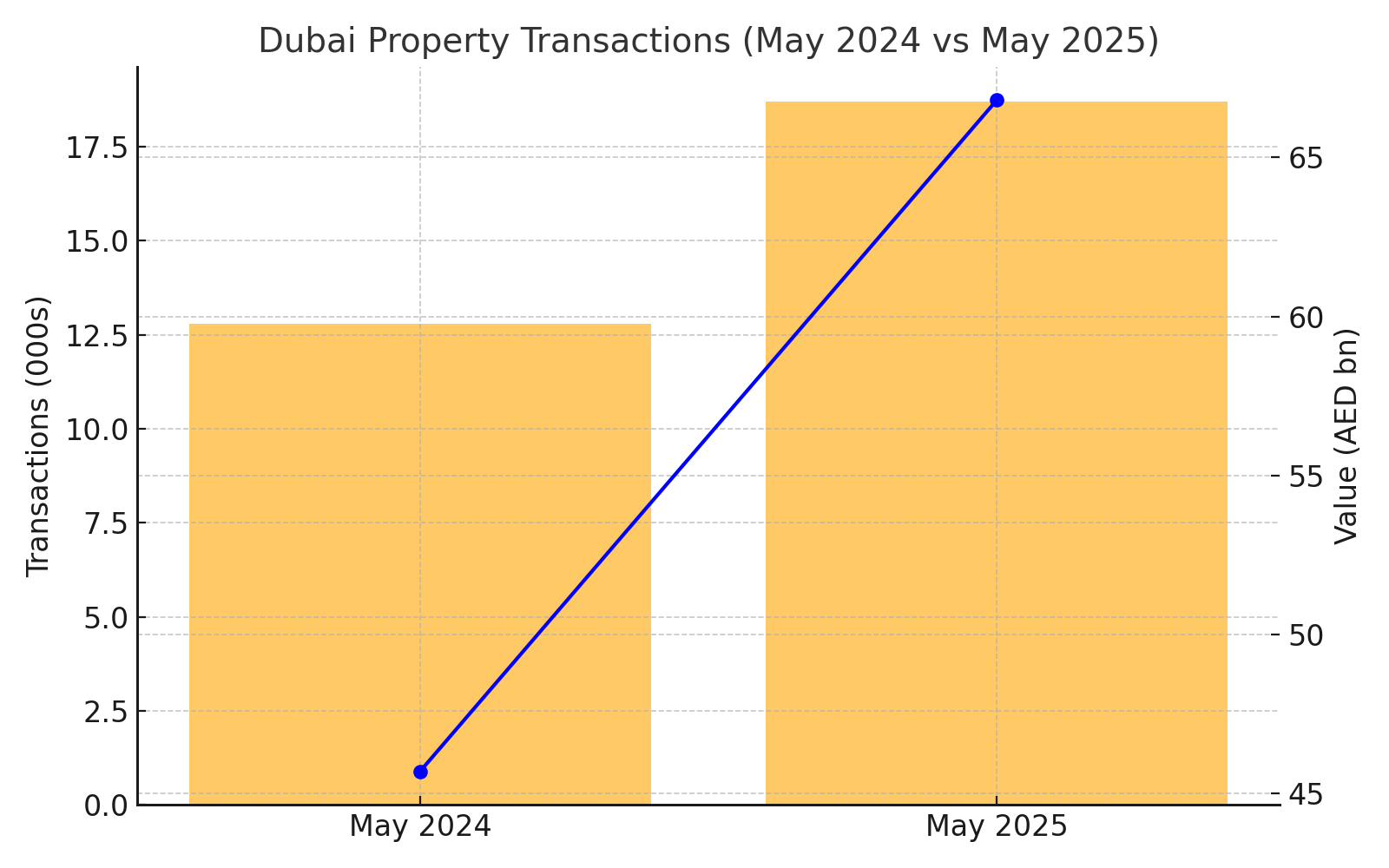

Transactions: May 2025 hit AED 66.8B in sales, up 46% vs May 2024.

-

Risks: 200k+ new units due by 2026 → possible 10–15% correction.

What’s Driving Demand

-

Population growth & strong inbound expat investors.

-

Visa reforms & Golden Visa eligibility.

-

Flexible off-plan payment plans (30/70, 40/60, 1% monthly).

-

Favorable currency rates attracting UK & EU buyers.

Investor Playbook

-

Income → 1–2BR apartments in high-yield areas (7–9%).

-

Capital Growth → Ready villas/apartments in prime, supply-tight locations.

-

Be Selective with Off-Plan → Stick to reputable developers.

-

Manage Risk → Stress-test deals for −10–15% price dip.

Outlook

Dubai remains attractive for global investors — strong yields, lifestyle appeal, and tax benefits. But timing and location matter more than ever in 2025.

Conclusion

Dubai’s real estate market in 2025 continues to offer strong opportunities for both yield-seeking investors and those focused on long-term capital growth. Prices are rising, rental yields remain attractive compared to global benchmarks, and transaction volumes are at record highs.

However, with more than 200,000 new units due by 2026, investors must be selective and strategic. Established communities, reputable developers, and balanced portfolios will likely outperform speculative or oversupplied projects.

Bottom line: Dubai remains a global property hotspot — but success in 2025 will depend on choosing the right project, location, and timing.